Introduction

GBC is dedicated to the financial services sector in the Emerging Markets and the Middle East.

A new competitive landscape is emerging post the financial crisis along with a stronger regulatory oversight of the global banking sector. Regionally the banking sector is in for a period of slower economic growth and increasing challenges to generating profits. Weakening balance sheets due to an increase of non-performing loans is further adding pressure to meet capital adequacy guidelines. Global banks are revisiting their business model and reducing their geographic footprint in light of the post crisis market realities. The emphasis is shifting to a more focused growth. Some of the global banks are divesting retail operations in select markets while retaining their corporate banking businesses. This development is seeing the advent of specialist players targeting selected elements of the value chain. The developed markets have already witnessed product specialists taking substantial market share from traditional global players.

The uncertain macro-economic environment, the weakening balance sheets and the potential for digital disruption is posing new challenges for the banking sector, the position of traditionally successful financial institutions in the Emerging Markets and the Middle East is likely to be jeopardized and the very survival of smaller players will be at stake. Proactive financial institutions need to strengthen their positions through focused growth, consolidation and strategic acquisitions.

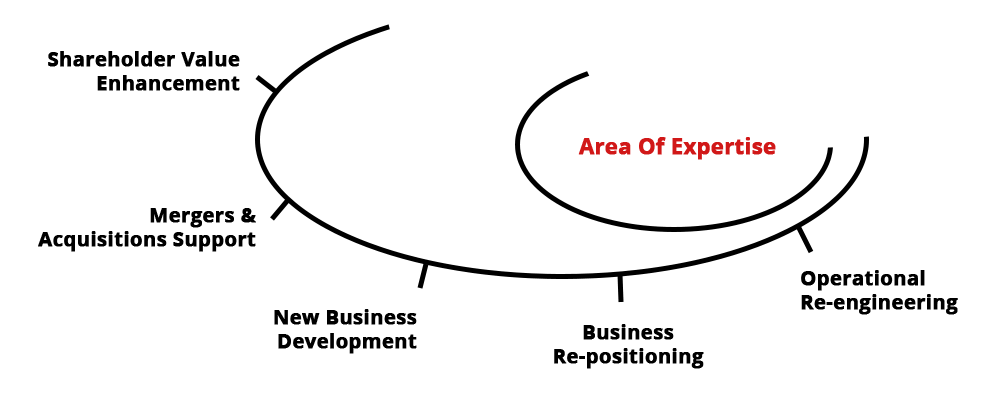

GBC’s objective is to assist our clients in executing business strategies for this rapidly changing environment. Our experience and analysis suggests that banks must understand and face these challenges head on to emerge successful.